I have reviewed a number of reward credit cards on this blog, including for Cebu Pacific Airlines, the low cost carrier! Now, Union Bank of the Philippines is offering the Cebu Pacific GetGo Visa Debit Card – the first and only debit card to earn GetGo Rewards points and one of the few rewards debit cards in the world – find out all the details and whether it’s worth signing up for it!

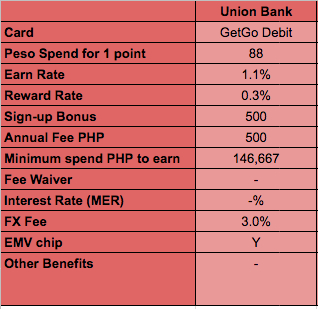

Few debit cards offer reward points, so it’s great to see Union Bank offer one for Cebu Pacific’s GetGo Rewards program: Here is a summary of what the Cebu Pacific GetGo Visa Debit Card offers:

Few debit cards offer reward points, so it’s great to see Union Bank offer one for Cebu Pacific’s GetGo Rewards program: Here is a summary of what the Cebu Pacific GetGo Visa Debit Card offers:

- 500 Point sign-up bonus

- Earn Points for Spend

You earn 1 point per PHP88 spent and points are automatically transferred to GetGo every month. That’s a reward rate of 0.3%, not much but better than nothing - Fees

There is a PHP500 annual fee as well as ATM fees, even at Union Bank ATMs, unusual for debit cards! The terms don’t list a foreign exchange fee, but I’d expect it to be the same 3% as the Union Bank GetGo Visa credit card!

Union Bank currently offers a sign-up bonus of 500 GetGo points, worth PHP150 (USD3) – not much, but better than nothing.

The debit cards earn rate of 1 point per PHP88 reflects a reward rate (or discount) of 0.3% – that’s much lower than the GetGo credit cards offering 1pt/PHP30 (or 1% discount), but it’s the only debit card to offer any reward points at all.

Most debit cards I have seen in the Philippines don’t charge an annual fee or ATM fees at the issuing bank’s ATMs, so the annual fee of PHP500 and the ATM fees of PHP10-175 are obviously offsetting the awards, making it more difficult to tell whether the card makes sense or not. Let’s assume you use a domestic ATM 4 times per month and an international one 2 times per year, resulting in ATM fees of PHP830, for a total of PHP1,330 of fees per year. You would have to spend more than PHP390,000 per year to offset the fees, before you earn any rewards! If you have another ATM card for cash withdrawals without fees, you need to spend almost PHP150,000 to offset the annual fee of PHP500!

Bottomline: The Union Bank GetGo Debit Card sounds good on first sight, but the modest rewards barely offset the fees. If you have another ATM card for free cash withdrawals, spend at least PHP150,000 per year on your debit card and don’t want to risk carrying a balance with high interest, the GetGo debit card can be an introduction to rewards cards!

For most people who can qualify for a credit card and pay off their balance every month (read my advice for rewards cards FIRST), applying for the Union Bank GetGo Visa Credit Card is more cost effective and rewarding!

I want to apply for getgo debit card with initialdeposit if 20k pesos ,how long will it take to get my card

Sorry, you’ll have to ask Union Bank for their estimate.

My own cards (from different banks in the Philippines) have taken between 2-4 weeks to arrive…

Hi, i applied my getgo debit card just 2 weeks ago, filled up the form online, went to unionbank, presented my id, paid 500 pesos and received my card in just 10mins 🙂

That’s very quick – thanks for providing that info, it will be helpful for other people interested in the card!

Within the day after the application process. The GET GO ATM is already ready. They just need to print your name on the card.

That’s great news, thanks for the update!

Youll get the card on the same day you apply. Got mine right away

That’s great, thanks for the update!

Just to share also. i got mine ( debit card) and pay Php 500 fee.

and it easy to redeem the card.

FYI on flyers I have read: you can earn 1 Get Go for every Php 88 spent with visa, such as online purchases and payments made at the cashier. always pay w/ visa getgo to earn more getgo points.

What are the requirements po?

Union Bank’s only requirement listed on the website is: 2 Identification Documents. You can find the details here

You can also check out their GetGo Prepaid card as an even easier alternative – read my review here!

Hi who could help me, Am I correct that onlu getgo members with union bank can avail those exclusive promo of cebpac?

No, the Piso sales and other promotions are available to all members, although there might be specific promotions for Union Bank customers.

Got mine within 30 mins.thus morning.

The annual fee of 500 (even for debit cards) is paid EVERY YEAR? or just on your first year?

The annual fee on credit and debit cards is due each year at renewal.

What the? The 500php. Annual Fee is absurd. Union Bank PH charges an annual fee to their debit card holders/depositors. I prefer high initial deposit with no A.F. rather than zero (0) initial deposit with yearly 500php. A.F.

Peace.

yeah, you kinda pay for the points you are earning, so it’s only interesting if you have a lot going through your visa card and don’t have access to (better) credit cards…

how about the activation? try to sign up on the website for online banking and there’s an error. I received the card for 1 week already. Anything I need to do?