Cebu Pacific Airlines, the low-cost carrier in the Philippines, partnered with Union Bank to offer two credit cards earning points in the airline’s GetGo Rewards program with your daily spend. Both cards offer a good earning ratio and automatic points transfer and the GetGo Platinum card offers additional travel benefits – find out all the details and whether it’s worth signing up for one of the cards!

If you are new to this site, please read “how we evaluate credit cards”. I have not held either one of the Union Bank cards, receive no compensation for this review and have no affiliate links.

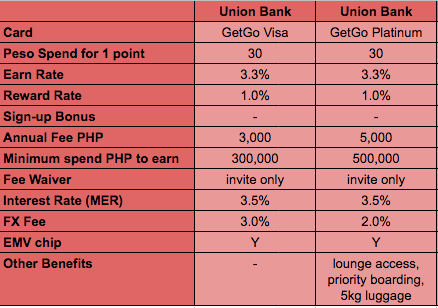

Here is a summary of what the Cebu Pacific GetGo Visa card offers:

- There is currently no sign-up bonus for this card and no anniversary bonus.

- Earn Points for Spend

You earn 1 point per PHP30 spent and points are automatically transferred to GetGo every month. That’s a reward rate of 1%, similar to other credit cards in the Philippines. - PHP3,000 annual fee, waived for select customers invited to the card, 3% foreign exchange fee, EMV chip

In comparison, the premium Cebu Pacific GetGo Platinum Visa card requires a minimum monthly salary pf PHP100,000 and offers the following additional benefits:

- Free 5kg luggage allowance when purchasing at least 15kg of check-in luggage.

- Airport Lounge access at Manila and Davao airports

- Priority boarding at select airports

- PHP5,000 annual fee, waived for select customers invited to the card, 2% foreign exchange fee, 3.5% interest, various other fees, EMV chip

While Union Pacific offered a sign-up bonus during launch, there is currently no bonus available. If you are interested in the card and not in a hurry, I’d wait for a promotion to sign up. I’ve seen promotions during travel events for various cards here in Manila.

While Union Pacific offered a sign-up bonus during launch, there is currently no bonus available. If you are interested in the card and not in a hurry, I’d wait for a promotion to sign up. I’ve seen promotions during travel events for various cards here in Manila.

Both GetGo cards offer an earn rate of 1 point per 30PHP – that’s similar to the Citibank Premier Miles card or cards partnering with Philippine Airlines MabuhayMiles program. At a point value of PHP0.3, you basically get a 1% earn rate or discount when using the card. The points transfer automatically to your linked GetGo account, making it easy to use. But less flexible than the Citibank Premier Miles card that allows transfer to more valuable points like Singapore Airlines KrisFlyer program!

The foreign exchange fees of 3% (2% for the Platinum card) are typical for credit cards in the Philippines, the Platinum card fee is lowest I have found for travel rewards cards!

The annual fee of PHP3,000 for the regular card is pretty high – you will have to spend PHP300,000 per year (or PHP25,000 per month) with the card to make up for the fee, before you earn any rewards!

There is also a 3.5% interest charge as well as various other fees – read the terms & conditions carefully before applying!

The Platinum card has an even higher fee of PHP5,000 (or spend of PHP500,000 per year), but the lounge access to the SkyView Lounge at Manila’s NAIA Terminal 3 and the Miacor Lounge in Davao can be valuable for frequent travelers. The additional baggage allowance of 5kg requires you to pay for at least 15kg. The pre-boarding benefit will be difficult to obtain – Cebu Pacific typically pre-boards seniors, handicapped and family travelers, but doesn’t have a premium boarding like AirAsia, so you’ll have to show your credit card and ask to pre-board – which may or may not be allowed!

Bottomline: The Union Bank GetGo Visa card offers a good earn ratio, but you need to spend more than PHP25,000 per month to start earning rewards. The GetGo Platinum Visa card has an even higher fee, but the lounge access can take the sting out of flying a low-cost carrier, making the experience a little more comfortable.

If Cebu Pacific is your airline of choice, the Union Bank GetGo Visa cards are an easy way to earn rewards as long as you spend at least PHP300,000/PHP500,000 per year. If you already are a Union Bank customer, I’d inquire about a fee waiver as well as any promotions, before signing up – it can significantly increase your rewards!

For most people, a card earning flexible rewards like the Citibank PremierMiles is more useful. You earn higher rewards and you can use your points at more airlines and for premium travel!

Hello,

I would just like a clarification on this statement:

“The Union Bank GetGo Visa card offers a good earn ratio, but you need to spend more than PHP25,000 per month to start earning rewards.”

What “rewards” are you pertaining to here? Is this getgo points? Or are there other rewards that I can earn which I can only earn by spending 25,000 per month? Please clarify. Thanks!

The annual fee of the card is PHP3,000. If you spend less than PHP25,000/month, the GetGo reward points you earn are worth less than the annual fee. It would cost you more to have the card than the rewards you earn.

Therefore, if you spend less than PHP25,000 per month on your credit card, you are better off using a credit or debit card without an annual fee! Most Visa/MasterCart Debit cards issues in the Philippines to use at ATMs can also be used anywhere the Visa/MasterCard logo is displayed, serving a similar function as a credit card, without the fees!

How does Unionbank GetGo Visa “invite only” free annual fee work? I mean how do you get invited for free annual fee? Also, can you pay Unionbank GetGo via the BPI online bills payment facility? One of my qualifications for a card is easy payment thru BPI. Thanks!

This type of “invite only” benefit is usually reserved for a bank’s best customers, requiring a good relationship, high balances or frequent card use.

I don’t have a relationship with Unionbank myself – you’d have to ask at a branch or by phone what the requirements are. You might be able to “negotiate” it!

I don’t know option to pay with BPI online – you should be able to search on the BPI online payment facility for the merchant to find out!

Good Day!

I receievd an email regarding a credit card statement worth 3000 na naka pangalan po sa akin.I assume po na annual fee yun. Although nag apply po ako last time for a credit card, wala pong naideliver sa akin at wala po akong narereceived. If ever po na approved ako, kindly please let me know,and please deliver the card and if not approved naman, please fix that matter, kasi po baka magka problema ako sa situation na yan.Thanks po.

Please direct your inquiry to the Bank issuing the credit card. I can’t help you with that.

Someone from GetGo Cebu Pacific called me up today to offer it’s credit card under Union Bank. Does that qualify as “invite only”? I’m not even a Union Bank client. Thanks.

I am not aware of any “invite-only” GetGo products from Union Bank. This might be just a marketing effort based on you flying Cebu Pacific or being a GetGo member…

Good day!

Should I pay the annual fee kahit na hindi ko pa nagagamit yung card and hindi pa naactivate? And also what will happen if I did nit py the annual fee?

Thank you

Good day!

I received an email from union bank that I need to pay annual fee. Should I pay the annual fee eventhough I did not use the credit card? And also it has not been yet activated.

Thank you

If you have the card, even you didn’t activate it, you do owe the fee. If you don’t need the card, I suggest you cancel it and ask Union Bank to waive the fee.

I received a GetGo credit card from CebPac good addition tho’. 😀

Do you know how much is the initial credit limit of GetGo Platinum Visa? Thanks!

Sorry, this depends on the individual applicant – only the bank will be able to tell you!

Can i use getgo points to offset the annual fee? Thanks

Sorry, to my knowledge you can’t use GetGo points to offset the fee.