The credit card I recommend most to people new to the world of points & miles is the IHG Rewards Club MasterCard from Chase: Not only can you earn 80,000 points for signing up (enough for up to 16 free nights), you also get a free night at any Intercontinental Hotel Group property, every year you renew the card! For an annual fee of US$49, you can stay at amazing properties like the Intercontinental Bora Bora Resort, or Intercontinental hotels in expensive city destinations like New York, Paris, London, Hong Kong or Tokyo, offering you a dream stay and saving you hundreds of dollars in the process!

If you are new to this site, please read “how we evaluate credit cards”.

IHG Rewards Club is the rewards program of the Intercontinental Hotel Group, one of the largest hotel group in the world with more than 5,000 hotels world wide, including Intercontinental, Holiday Inn, Holiday Inn Express and a number of other chains.

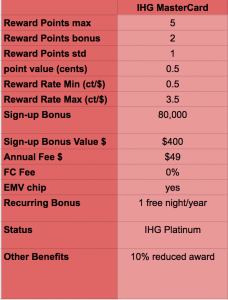

Here is a quick summary of the IHR Rewards card:

Sign-up bonus of 80,000 points, worth about US$400

Sign-up bonus of 80,000 points, worth about US$400

You receive 80,000 points after spending US$1,000 in the first 90 days from signing up. The points from the bonus and minimum spend are enough for 8 nights at 10% of their cheapest hotels or 2 nights at 90% of their properties. You can get as many as 16 free nights during PointBreaks Promotions!- Earn Points for Spend

You earn 5 points for every US$ spent at IHG properties, 2 points per US$ spent for groceries, restaurants or gas and 1 point everywhere else

While the earning at IHG properties is ok, the 1 point everywhere is a low earning rate. I value IHG points at 0.5ct each, so this equals an award rate of only 0.5%, less than most rewards card out there who will offer 1-2%! - IHG Rewards Club Platinum Status

As long as you hold the Visa card, you will have Platinum Status in the IHG program, which is the second highest status across all their hotels! It provides you with preferential treatment, like late check-out, free upgrades and increased point earning rates. - 10% Rebate on Reward Redemption

With the card you will also get a 10% rebate on reward redemptions. It is posted as a credit after making the redemption, so you will need the full points to book. For example, after booking the Intercontinental Bora Bora for 50,000/night, you will get 5,000 points credited back to your account. - $49 annual fee, no foreign exchange fee, EMV chip

I consider the $49 annual fee a bargain, because with every renewal, you will receive a free night voucher, valid for one year at any of over 4,800 IHG properties world wide. Considering that some properties can be more than $1,000, it’s an incredible value for stays at aspirational properties you might not be able to afford otherwise! If you and your partner both sign up, you will have 2 nights to make for a great weekend getaway. I have used my free nights for stays at Intercontinental Hong Kong and New York for great value and found the availability to be very good! There is no foreign exchange fee for purchases abroad, saving you 1-3% over cards with the fee! - The IHG Rewards MasterCard is issued by Chase Bank and requires very good credit. Chase Bank is one of the biggest players in the rewards card space, has been very aggressive in launching cards with strong benefits over the last few years and is relatively easy to get approved for.

Bottomline: While there are credit cards with more perks and higher earn rates, the high sign-up bonus makes it a great card to get and the free night certificate for a relatively low fee makes it a great card to hold (even if you don’t use it outside IHG hotels).

With so many hotels around the world, even outside the major tourist destinations abroad, it’s especially useful for international travelers! Platinum elite status has given me preferred treatment, including upgrades to beautiful suites on many stays, making my travels a little more comfortable.

I’ve held the IHG Rewards Club card for years and am planning to hold it as long as they offer the current benefits! It’s great value and I’ll recommend it for anybody interested in a travel rewards card!