American Express became the exclusive issuer of Hilton Honors affiliated credit cards in January 2018 and is now offering 4 business and personal cards. The AmEx Hilton Honors card carries no annual fee, eliminates the previous foreign exchange fee and offers the most basic benefits of all their cards. It’s designed for infrequent travel and anybody who is not comfortable with annual fees for credit cards!

If you are new to this site, please read “how we evaluate credit cards”. I do not receive any compensation for credit card links on this page. I previously held the prior iteration of this card.

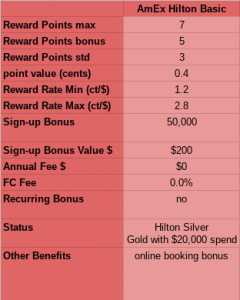

The HiltonHHonors card from American Express is one of the few rewards cards without an annual fee, so let’s look a summary of what you can expect from this card:

Sign-up bonus of 50,000 points, worth about US$200, after spending $1,000 in three months – that’s a decent bonus for a very low minimum spend

Sign-up bonus of 50,000 points, worth about US$200, after spending $1,000 in three months – that’s a decent bonus for a very low minimum spend- Earn Points for Spend

You earn 7 points per US$ spent at Hilton, 5 points/$ spent at US restaurants, supermarkets and gas stations and 3 points/$ on everything else. At a value of 0.4 cents/point, that’s an earnings rate of 1.2 to 2.8 cents – not a lot, compared to other rewards card. - Hilton Honors Silver status

- Basic travel and shopping protection

- no annual fee, no foreign exchange fee, EMV chip

With a reward rate of 1.2-2.8%, the AmEx Hilton Honors is not really competitive. If you want to maximize your rewards, a no-fee 2% cash back card, like the Citibank Double Cash, is a better choice. The sign-up bonus of 50,000 points is good (for the previous card, they have been as much as 75,000 points) and does make it attractive for anybody who has never held this card before!

Hilton Honors Silver status is one step up from the regular “Blue” members and gives you a bonus of 15% on earning points, a 5th night free on award reservations, complimentary access to hotel gyms and two bottles of water – that’s not a whole lot of perks, but better than nothing.

Even though this is the most basic American Express card, you still get access to superior customer service. AmEx has some of the best fraud protection and personal service of any credit card company I’ve worked with!

American Express removed the foreign exchange fee for this card in 2018, making it much more attractive for international travel.

Bottomline: If you are just starting out in the world of miles & points and don’t want to sign up for annual fees on a credit card, the American Express Hilton Honors card is a good option. With the foreign exchange fee removed, it’s good to have for international travel and the Hilton Honors Silver status is a nice touch. The sign-up bonus alone might be worth signing up – and holding the card for international travel at no extra cost!

You can sign up for this card (or other AmEx Hilton cars) and read all the fine print here!